The Homebuying Process Explained Step by Step

Whether you are a first-time homebuyer, or it’s the first time in a while, you’re probably reading this to freshen up your home-buying knowledge. Here is the homebuying process explained step by step with Nest Builders Realty.

Speak to a Mortgage Lender about Pre-Approval and send the letter to your agent

This is one of the most important steps in the home-buying process. Knowing your budget helps us understand which homes to show you. Also, offers will not be presented to sellers unless accompanied by a mortgage pre-approval letter or proof of funds (POF) statement for cash buyers.

Clarity Call with a Nest Buyers Agent to answer questions and address concerns

This meeting will allow you to become more comfortable with us. At this time we will build the parameters of the home search together, review the process of purchasing a home, and answer any questions that you may have. Using the agreed-upon criteria, we will begin emailing you a list of homes for sale.

Looking to buy a home?

Review Agency Disclosure

Many people think that this refers to a contract – it doesn’t. Agency Disclosure is simply a form that clearly states all types of real estate relationships relevant to you, and our duties and obligations as Realtors® to you.

At Nest Builders, we also require our client to sign a Residential Buyer/Tenant Representation Agreement. This is a contract between both you and Nest Builders, representing you as an agency.

Look at homes with a Nest Builders Buyers Agent

By physically visiting homes, you get a better idea if it is a good fit for you. This can also help you narrow down the factors you are using to choose a home. It is also a great opportunity to ask us questions about the property. The average buyer sees 7-12 homes before making a decision on a home to purchase.

Select a home to purchase

This can be an exciting time for a home buyer, especially if the search process has taken longer than expected. It is at this point forward that having an experienced and ethical agent really matters.

Review Sellers Disclosures

The purpose of the disclosures is for the seller to tell the buyer what they know about various aspects of the property. There are certain things that the seller is legally obligated to disclose, and some that are voluntary. The disclosure statement is not a warranty of any kind, and does not take the place of an inspection performed by a qualified professional home inspector. Additionally, a Lead Based Paint Disclosure is required by law on any residential property built before 1978.

Compose the Purchase Agreement and Offer with your Nest Builders Buyers Agent

The main focus points of the purchase agreement are the offer amount, earnest money deposit, inspection timeline, closing timeline, and concessions (if any).

Additionally important now days are the terms of the offer, which include:

- Days until Closing

- Initial Repair Requests

- Offering the seller a leaseback

This may be completed in person or electronically.

Present and Negotiate Your Offer

Negotiations are typically handled over the phone or via email. Your agent’s fiduciary duty is to you, so they will do their best to get you the best deal. This process can result in multiple counteroffers between both parties before an agreement is reached and in some cases, the offer can be rejected.

Agreement is Reached and the Offer is Accepted

Changes made to the purchase agreement if any, will need to be completed and the final purchase agreement is to be signed by all involved parties.

Inspection with Licensed Inspector

You will typically have about 5-10 days to complete the home inspection, which will be specified in the option period time, dependent on the conditions of the purchase agreement. We have a list of trusted inspectors that we provide to our clients, but you may use whomever you choose. Any issues raised by the inspection that you want to be addressed by the seller will need to be negotiated.

Send Transaction Documents to Your Lender

Your Nest Builders Buyers Agent will send all relevant paperwork to your loan officer so that they can begin the process of administering and approving your loan.

Mortgage Company Orders and Appraisal of The Property

The appraisal is the bank’s method of ensuring that the property is worth equal or greater than the loan amount. This is typically done once the inspection has been completed, and all issues that arose out of it are satisfied. If the appraisal amount is lower than the purchase price or acceptable Loan-To-Value, further negotiation may be required. The appraisal is paid for by you, the purchaser, and included in your closing costs.

Mortgage Processed and Underwritten

The job of an underwriter is to assess a borrower’s risk profile. Factors that are used to determine a buyer’s full approval are the borrower’s ability to repay the mortgage, credit history, and home value and type of property being financed. During the process of buying a home, please consult your lender prior to making any other major purchases (automobile, large furniture purchase, etc). Not doing so may put your loan’s approval at risk.

Loan Commitment Approval

Your mortgage is approved. Hooray!

Coordinate Transfer of Utilities

Call gas and electric companies to have utilities transferred prior to closing, set to begin on the day of closing if the seller does not have occupancy as part of the purchase agreement, or on the day of key exchange if they do.

In Texas, the Seller is required to have the utilities remain on until closing.

Review Closing Papers a Day Before Closing

While your agent will review the closing papers, it is very important that you review them for errors as well. Reviewing the spelling of your name, your social security number and your closing figures are some key elements to verify when reviewing your closing documents.

Final Walk Through

This typically occurs on the day of closing, or the day before. This final inspection of the property before closing ensures that nothing has been removed that was not negotiated and that there have been no unexpected changes to the property (burst water pipe, a leaky roof, etc)

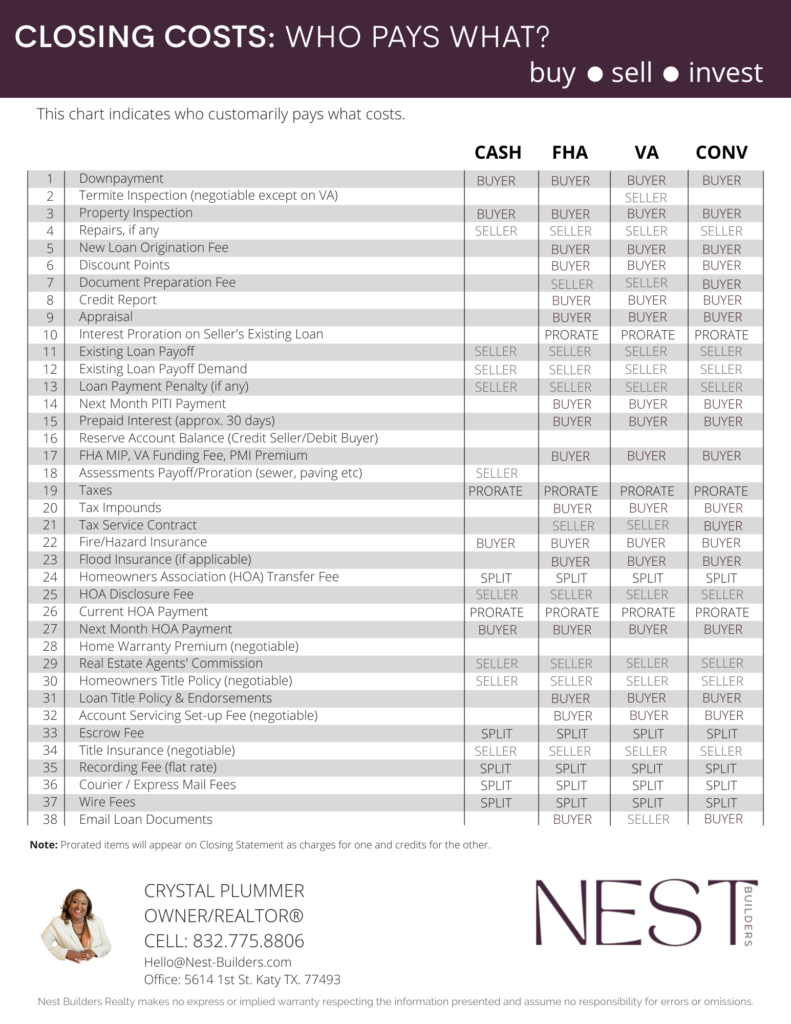

The Closing

Get your writing hand-prepped, because you will be signing your name in a lot of places. All negotiated monies are brought to the table. The chart below describes who typically pays for what during a transaction. This document is not the law! Negotiations are made during the transaction based on the market, and your specific terms are outlined in the 1-4 Family Contract signed.

The transaction is finalized.

Congratulations on your new home!

Occupancy and Key Exchange

This is only part of the transaction if the sellers need to continue living in the home after closing (i.e. to allow for the purchase of their new home to be complete). If so, the seller typically pays your mortgage payment (prorated daily) for the amount of time they occupy the property after closing. These funds are held by the title company until the end of the occupancy period. Occupancy can be any agreed-upon amount of time from 1-60 days. At the completion of the occupancy period, you will receive the keys to the home.